We consider how much it costs to bring a used car to Ukraine with and without “zero customs clearance”

Briefly about the cost of customs clearance of used cars from Europe / Photo: Getty Images, Collage: Today

Customs clearance of cars, despite the gasoline crisis that lasted for several months, remains a topical issue for many Ukrainians.

While the government decides whether to abolish “zero customs clearance”, the editors of “Segodnya” proposes to find out how much on average you need to pay for the import of “Euroblanks” into Ukraine.

How is the clearance process

The procedure itself involves several stages before the car drives into the garage of the new owner. Having bought a car, you need to draw up documents for it abroad. A possible option is to send a photo of the documents to a customs broker in Ukraine, but this is not necessary.

One of the most difficult operations is border crossing. Next, you should get a certificate of conformity and clear the car in Ukraine. In conclusion, you should register the car at the service center of the Ministry of Internal Affairs.

To help with “paper” issues, you can use the services of a customs broker. His services cost 300-600 US dollars (8.9-17.8 thousand UAH) – this is import processing, transaction planning, legal support.

When buying a used car, please note: it must comply with the environmental standard Euro 2 or higher, for new cars it is Euro 5. After buying it, you need to deregister it, “transplant” it to transit numbers and bring it to Ukraine within 30 days.

Border crossing

When crossing the border, the customs inspector puts a stamp on the export declaration. If the preliminary declaration is not executed, you will have to pay advance customs payments in hryvnia.

European cars have a VIN code that allows you to check the environmental standard at customs. If suddenly this is not possible, it is necessary to obtain a certificate of conformity in a specialized center in Ukraine – the average cost is 1400 UAH.

During customs clearance, a car drives into the customs control zone, where for each additional day of downtime, you will have to pay 90 UAH. During this period, customs calculates all payments with a surcharge by the driver or a refund of the difference. If the “Euro badge” has previously violated customs rules, an official payment to the budget in the amount of UAH 8,500 will have to be made – this is a voluntary contribution in order to avoid fines.

Already in Ukraine, the car owner needs to obtain a certificate of compliance with national standards. Cost – an average of 3000 UAH. To complete the customs clearance procedure, all documents are submitted to the service center of the Ministry of Internal Affairs and 600 UAH of administrative services and a tax to the Pension Fund (3-5% of the cost of a car without VAT) are paid.

We consider the cost

According to Ukravtoprom, 111,000 custom cars have been imported to Ukraine during the period of the bill, which exempted from paying VAT, excise duty and import duty on passenger cars. The most popular models were Volkswagen Passat, Volkswagen Golf, Renault Megane.

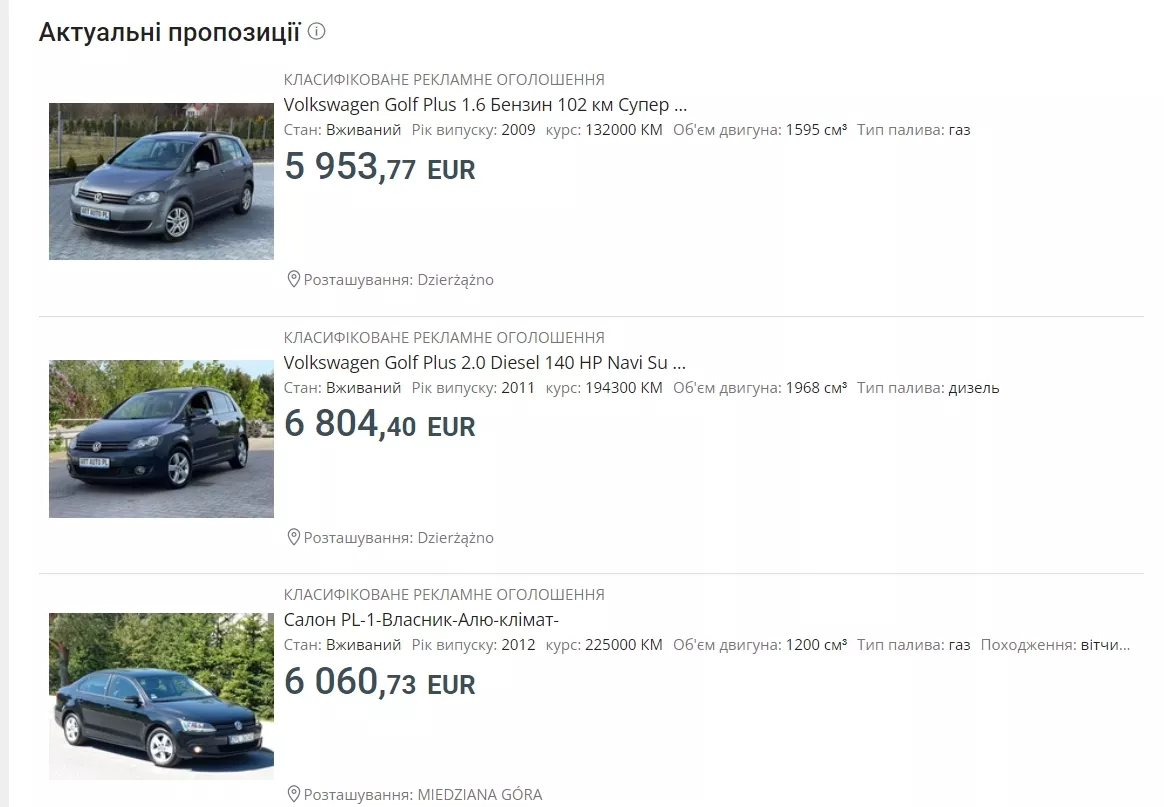

In Poland, on websites selling used Volkswagen Golf cars, they sell for approximately 6,000 euros (186.5 thousand UAH). Models of 2009-2011 with engines from 1.5 liters prevail. The situation is almost the same with used Volkswagen Passats, the average price of which is 6-7 thousand euros, the newer the more expensive.

Used cars on the Internet resources of Poland / Photo: screenshot

Among the offers you can find Renault Megane for 4000-5000 euros (124-155 thousand UAH). For many models, engines have a volume of up to 1.5 liters and a year of production – until 2010, which leads to a lower price.

If we consider the cost of a conditional Volkswagen Golf for 6,000 euros with “zero customs clearance”, that is, without import duties and excise taxes, the cost of a car with all payments will be 6,748 euros (UAH 209.8 thousand). Tax to the Pension Fund is UAH 5524, car registration – UAH 600, obtaining a certificate of conformity – UAH 4400, conditional parking at customs for 3 days – UAH 480, as well as customs broker services – UAH 12 thousand. Without additional services, the amount with customs payments will be 6,200 euros (UAH 192.8 thousand).

If the excise and import duties are returned, you will have to pay 3,000 euros more for customs clearance of a car with mandatory payments – approximately 9,200 euros (UAH 286,000). If additional services are required (broker, parking, certificate of conformity), the amount will increase to 9,768 euros (UAH 303.7 thousand).

Online in “Дії” and without corruption

The Verkhovna Rada has registered a package of laws providing for changes in the procedure for customs clearance of cars. In general, they propose to return the excise and duty on “Euro-plates”, with the exception of only those vehicles that are intended for the needs of the Armed Forces of Ukraine.

At the same time, Ukrainians should be allowed to clear cars online in a few clicks using the Diya state application. In one application, it will be possible to submit a declaration and make all payments, which should reduce the corruption component.

They want to calculate the cost of customs clearance according to a new formula, not counting the price of the car itself. Take into account the age, type and size of the engine, the exclusivity of the car.

Segodnya used to be told when drivers should expect the seasonal peak at gas stations and how Ukraine plans to export grain to world markets.

Source: Segodnya

I have been working in the news industry for over 10 years now and I have worked for some of the biggest news websites in the world. My focus has always been on entertainment news, but I also cover a range of other topics. I am currently an author at Global happenings and I love writing about all things pop-culture related.