As the Turkish lira accelerates its decline amid record inflation, the ruble on the stock exchange fell below 60

Turkish lira falls to the bottom, and the ruble is getting stronger / Photo: Getty Images, Collage: Today

Record inflation for 23 years, accelerating the fall of the Turkish lira, and the unwillingness of Turkish President Erdogan to raise the discount rate is actually destroying the state’s economy.

According to the Financial Times, on the day of June 8, the value of the lira against the dollar fell by about 2%. The currency’s losses are already estimated at 22% after falling nearly 45% in 2021. A year ago, one dollar had to pay an average of 8 Turkish liras.

Turkey’s “New Economic Model”

-59.5% is the real interest rate based on inflation in Turkey. These indicators imply negative real interest rates, do not allow citizens to keep their savings in lira and reduce the attractiveness for foreign investors in relation to other developing countries.

However, Erdogan promises to further reduce the discount rate of the Central Bank. He and his government are convinced that they are emulating the “new economic model” and that inflation can be curbed by weak currency to increase exports and investment, as well as by eliminating the trade deficit countries.

The President of Turkey is confident that such actions of the authorities will soon show their effectiveness.

Along with the fall of the lira, the ruble is strengthening

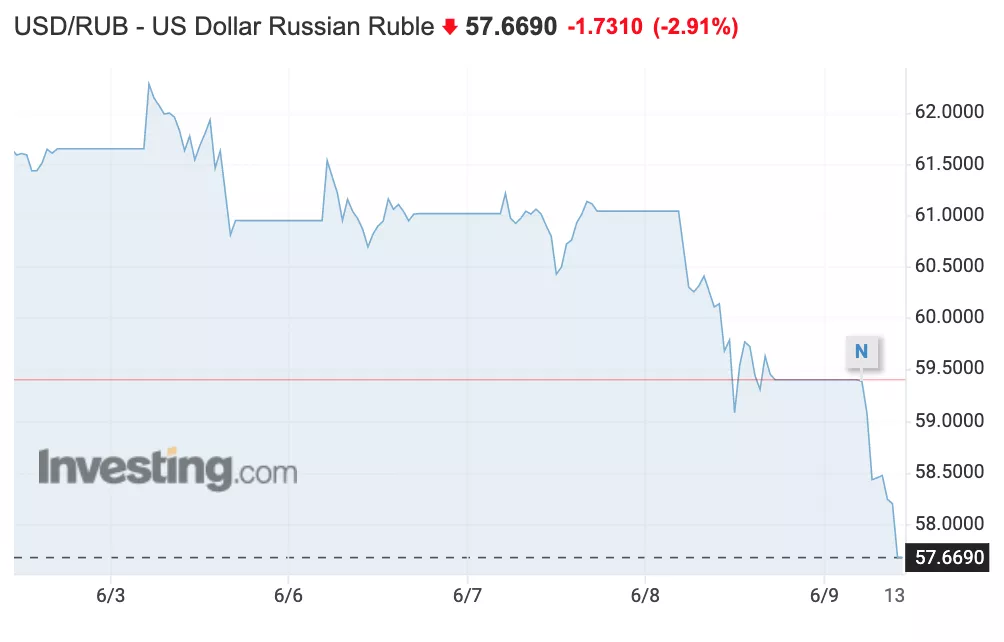

At the same time, the ruble is strengthening on the stock exchange on June 8 and 9, its value as of 14:14 Kyiv time, according to Investing, was 57.66 rubles per dollar.

The dynamics of the ruble against the dollar for the week / Photo: Investing.com

Experts attribute this to the rise in the cost of Brent oil above $123 per barrel and the high supply of foreign currency from exporters.

However, against the background of the strengthening of the ruble, the rise in prices for goods in the Russian Federation continues further. Earlier, a senior US Treasury official was reported by CNN to have said that the rapid recovery of the ruble was only possible thanks to Moscow’s attempts to artificially hold on to the ruble.

According to him, despite the fact that the ruble returned to pre-war levels, the purchasing power of this currency was significantly reduced due to the rapid rise in prices in Russia.

According to Bloomberg, the strengthening of the ruble is not credible, as many currency trading shops stopped trading the ruble because that its value on monitors does not match the price at which it can be traded in the real world.

The Central Bank kills the ruble

Due to the strict restrictions of the Central Bank of the Russian Federation, the Russian ruble has become an inconvertible currency.

As the former Deputy Chairman of the Central Bank of the Russian Federation Sergey Aleksashenko stated on the Popular Politics YouTube channel, the feature of a convertible currency is that any economic entity can exchange the national currency for any currency in the world at a single rate.

In the aggressor country, the actual rate differs from the rate on the stock exchange and in banks, and dramatically. If restrictions are lifted, then instead of 57 rubles, the dollar will cost 157 rubles.

Recall that the Verkhovna Rada has already registered a number of laws that completely prohibit the circulation of bloody currency in Ukraine and its use for international transfers and settlements.

We also talked about how Putin was outmaneuvered by two EU countries and agreed on their own.

Source: Segodnya

I have been working in the news industry for over 10 years now and I have worked for some of the biggest news websites in the world. My focus has always been on entertainment news, but I also cover a range of other topics. I am currently an author at Global happenings and I love writing about all things pop-culture related.